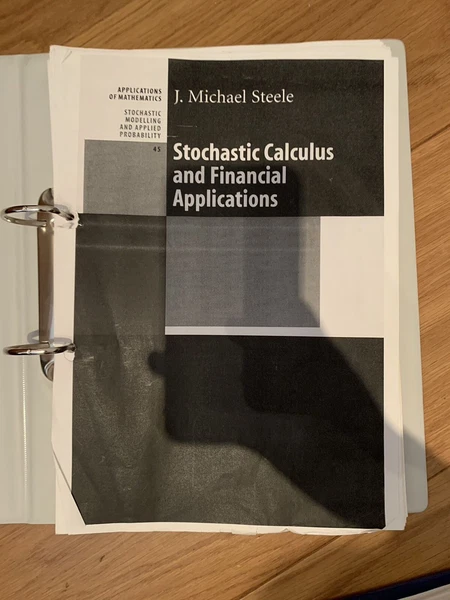

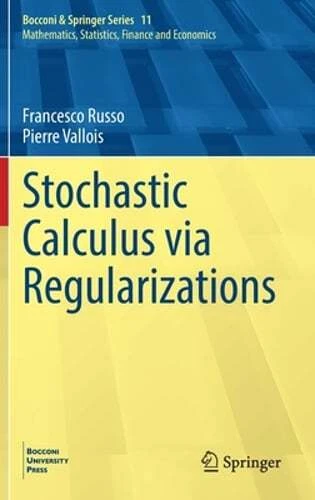

Description: "A wonderful display of the use of mathematical probability to derive a large set of results from a small set of assumptions. In summary, this is a well-written text that treats the key classical models of finance through an applied probability approach....It should serve as an excellent introduction for anyone studying the mathematics of the classical theory of finance." --SIAM Steven E. Shreve is Co-Founder of the Carnegie Mellon MS Program in Computational Finance and winner of the Carnegie Mellon Doherty Prize for sustained contributions to education. 1 General Probability Theory 1.1 In.nite Probability Spaces 1.2 Random Variables and Distributions 1.3 Expectations 1.4 Convergence of Integrals 1.5 Computation of Expectations 1.6 Change of Measure 1.7 Summary 1.8 Notes 1.9 Exercises 2 Information and Conditioning 2.1 Information and s-algebras 2.2 Independence 2.3 General Conditional Expectations 2.4 Summary 2.5 Notes 2.6 Exercises 3 Brownian Motion 3.1 Introduction 3.2 Scaled Random Walks 3.2.1 Symmetric Random Walk 3.2.2 Increments of Symmetric Random Walk 3.2.3 Martingale Property for Symmetric Random Walk 3.2.4 Quadratic Variation of Symmetric Random Walk 3.2.5 Scaled Symmetric Random Walk 3.2.6 Limiting Distribution of Scaled Random Walk 3.2.7 Log-Normal Distribution as Limit of Binomial Model 3.3 Brownian Motion 3.3.1 Definition of Brownian Motion 3.3.2 Distribution of Brownian Motion 3.3.3 Filtration for Brownian Motion 3.3.4 Martingale Property for Brownian Motion 3.4 Quadratic Variation 3.4.1 First-Order Variation 3.4.2 Quadratic Variation 3.4.3 Volatility of Geometric Brownian Motion 3.5 Markov Property 3.6 First Passage Time Distribution 3.7 Re.ection Principle 3.7.1 Reflection Equality 3.7.2 First Passage Time Distribution 3.7.3 Distribution of Brownian Motion and Its Maximum 3.8 Summary 3.9 Notes 3.10 Exercises 4 Stochastic Calculus 4.1 Introduction 4.2 It^o's Integral for Simple Integrands 4.2.1 Construction of the Integral 4.2.2 Properties of the Integral 4.3 It^o's Integral for General Integrands 4.4 It^o-Doeblin Formula 4.4.1 Formula for Brownian Motion 4.4.2 Formula for It^o Processes 4.4.3 Examples 4.5 Black-Scholes-Merton Equation 4.5.1 Evolution of Portfolio Value 4.5.2 Evolution of Option Value 4.5.3 Equating the Evolutions 4.5.4 Solution to the Black-Scholes-Merton Equation 4.5.5 TheGreeks 4.5.6 Put-Call Parity 4.6 Multivariable Stochastic Calculus 4.6.1 Multiple Brownian Motions 4.6.2 It^o-Doeblin Formula for Multiple Processes 4.6.3 Recognizing a Brownian Motion 4.7 Brownian Bridge 4.7.1 Gaussian Processes 4.7.2 Brownian Bridge as a Gaussian Process 4.7.3 Brownian Bridge as a Scaled Stochastic Integral 4.7.4 Multidimensional Distribution of Brownian Bridge 4.7.5 Brownian Bridge as Conditioned Brownian Motion 4.8 Summary 4.9 Notes 4.10 Exercises 5 Risk-Neutral Pricing 5.1 Introduction 5.2 Risk-Neutral Measure 5.2.1 Girsanov's Theorem for a Single Brownian Motion 5.2.2 Stock Under the Risk-Neutral Measure 5.2.3 Value of Portfolio Process Under the Risk-Neutral Measure 5.2.4 Pricing Under the Risk-Neutral Measure 5.2.5 Deriving the Black-Scholes-Merton Formula 5.3 Martingale Representation Theorem 5.3.1 Martingale Representation with One Brownian Motion 5.3.2 Hedging with One Stock 5.4 Fundamental Theorems of Asset Pricing 5.4.1 Girsanov and Martingale Representation Theorems 5.4.2 Multidimensional Market Model 5.4.3 Existence of Risk-Neutral Measure 5.4.4 Uniqueness of the Risk-Neutral Measure 5.5 Dividend-Paying Stocks 5.5.1 Continuously Paying Dividend 5.5.2 Continuously Paying Dividend with Constant Coeffcients 5.5.3 Lump Payments of Dividends 5.5.4 Lump Payments of Dividends with Constant Coeffcients 5.6 Forwards and Futures 5.6.1 Forward Contracts 5.6.2 Futures Contracts 5.6.3 Forward-Futures Spread 5.7 Summary 5.8 Notes 5.9 Exercises 6 Connections with Partial Differential Equations 6.1 Introduction 6.2 Stochastic Differential Equations 6.3 The Markov Property 6.4 Partial Differential Equations 6.5 Interest Rate Models 6.6 Multidimensional Feynman-Kac Theorems 6.7 Summary 6.8 Notes 6.9 Exercises 7 Exotic Options 7.1 Introduction

Price: 136 AUD

Location: Hillsdale, NSW

End Time: 2025-01-09T23:40:11.000Z

Shipping Cost: 31.24 AUD

Product Images

Item Specifics

Return shipping will be paid by: Buyer

Returns Accepted: Returns Accepted

Item must be returned within: 60 Days

Return policy details:

EAN: 9780387401010

UPC: 9780387401010

ISBN: 9780387401010

MPN: N/A

Item Length: 23.6 cm

Item Height: 235 mm

Item Width: 155 mm

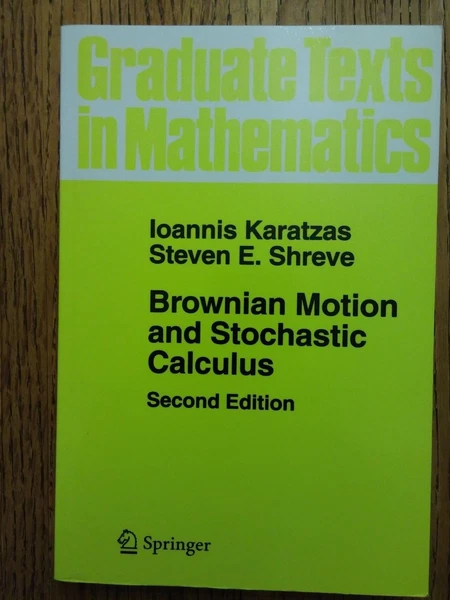

Author: Steven Shreve

Publication Name: Stochastic Calculus for Finance II: Continuous-Time Models

Format: Hardcover

Language: English

Publisher: Springer-Verlag New York Inc.

Subject: Accounting, Finance, Mathematics

Publication Year: 2010

Type: Textbook

Item Weight: 2160 g

Number of Pages: 550 Pages